| Jump$tart National Clearinghouse

Contains a wealth of resources and lesson plans. You can search here

|

|

| Bank of America Better Money Habits

Bank of America has partnered with Khan Academy to create Better Money Habits. Their innovative approach to online education inspired us to deliver financial information in a different and engaging way. It’s available to all, free of charge and has videos on topics like budgeting, saving, understanding credit and home buying. |

|

| BizKid$

BizKid$ is a national financial education initiative based on an Emmy Award-winning public television series about kids, money, and business. Using a blend of education and entertainment, each BizKid$ episode shows kids how to make and manage money by introducing concepts of financial literacy and entrepreneurship. The show is complemented by a resource rich website, video games, free downloadable lesson plans with mapping to all national standards and multiple state standards, teacher guides.

|

|

| Boston

With our educational materials, partnerships, research and outreach efforts in communities throughout New England, we aim to contribute to the rising financial capabilities and economic success of our residents and to the growth of our regional economy. |

|

|

Chicago

The Federal Reserve Bank of Chicago believes that economic and financial literacy serve critical roles in helping consumers make better decisions with their money. The path towards economic and financial understanding can begin as early as elementary school. The Federal Reserve Bank of Chicago has prepared its Econ Explorers curriculum to help get this process started and make it fun for both student and teacher. |

| Clay Piggy

Clay Piggy is a gaming portal which teaches children basic personal financial management skills, including understanding of income, money management, saving, investing, spending and credit in a fun and social way. It is based on national standards in K-5 personal financial literacy. |

|

|

Cleveland

Play our online games. Can you trade your way home from the Barter Islands before the sun sets? Do you want to see what money looks like in other countries? Do you wonder how many different versions of U.S. money have President Washington’s picture? |

| Consumer Jungle – Clear Your Way Through the Financial Jungle – Master Your Money!

The Consumer Jungle has been transformed into a youth-oriented website. It was designed to provide young adults with financial resources and ways to share stories and interact with their peers. This website has also been designed to be a resource for your classroom! Check out the top 10 ways to use Consumer Jungle in your classroom here. This new website hosts many different content articles, student-created articles from our Student Editors, interactive financial literacy games, many different contest opportunities, and much more! Your students can become involved in Consumer Jungle by becoming a Student Editor, commenting on different articles and games, and participating in contests (either individually or within your class). If you have any questions regarding the Consumer Jungle website transition, please check out our Frequently Asked Questions page or contact us directly. |

|

|

Dallas

Federal Reserve Bank of Dallas – Building Wealth is a personal finance education resource that presents an overview of wealth-building strategies for consumers, community leaders, teachers and students. |

| EconEdLink

EconEdLink provides a premier source of classroom-tested, Internet-based economic and personal finance lesson materials for K-12 teachers and their students. With over 464 lessons to choose from, teachers can use as many of the lessons as they would like and as often as they would like. |

|

|

Earn Your Future

PwC’s Earn Your Future curricula are composed of easy-to-follow lesson plans accompanied by interactive handouts. The curricula is free and available to download for easy access to financial literacy education. There are 30 financial literacy modules spanning grades 3 through 12 and that cover Saving & Investing, Career Exploration, and Planning & Money Management topics. |

| EverFi

The EverFi™ – Financial Literacy high school program is a 10 module, 6-hour co-curricular learning platform that covers hundreds of key topics including credit scores, budgeting, insurance, credit cards, student loans, mortgages, taxes, stocks, savings, 401k’s and other critical concepts. Individual student progress and knowledge gains are tracked, and the modular structure gives high schools the flexibility to implement in economics, business, or social studies courses. EverFi uses the latest technology – video, animations, 3-D gaming, avatars, and social networking – to bring complex financial concepts to life for today’s digital generation. Click here to learn more and to order.

|

|

| Federal Reserve

Clearinghouse of educational programming for all Federal Reserve Districts. |

|

| FDIC Money Smart

Money Smart is a free financial literacy program for young adults, adults and business consumers. The FDIC’s Money Smart for Young Adults curriculum helps youth ages 12–20 learn the basics of handling their money and finances, including how to create positive relationships with financial institutions. Equipping young people in their formative years with the basics of financial education can give them the knowledge, skills, and confidence they need to manage their finances once they enter the real world. |

|

| GEN I Revolution

The GEN I Revolution consists of fifteen interactive missions in which students complete a variety of activities to help them learn important personal finance concepts. With each mission, students are introduced to a character who is facing a particular financial crisis. As part of the Gen I Revolution, the student learns about the crisis, strategically selects “Operatives,” and then completes activities with the ultimate goal of solving the mission. The Gen I Revolution game (free) is part of the Learning, Earning and Investing educational program (fee based). This is a multifaceted, comprehensive education program for students in grades 4 through 12. |

|

| H&R Block Budget Challenge

The H&R Block Budget Challenge is a free teen financial literacy program in the form of an online game that simulates real life as an adult: paying bills, managing expenses, saving money, investing in retirement, paying taxes and more. Participants play classroom against classroom and students against students in this learning-by-doing simulation.

|

|

| Hands on Banking

The Hands on Banking program provides the essentials of financial education, real-world skills, and knowledge every student can use. The Hands on Banking online financial courses include free instructor guides with classroom lessons and activities that will help you guide students through real-life scenarios, group discussions, and other activities designed to teach valuable money management skills and help them take control of their finances. |

|

| How the Market Works

is an interactive stock simulator. When you register for free, you will receive a brokerage account with a virtual $25,000 in cash and you will be able to begin trading immediately. To help you get started, visit our Education Center for hundreds of articles, videos and tutorials. Teachers, professors, and all registered users can also create their own private contest and challenge their students or friends. Best of all, this site is completely free! |

|

|

Kansas City

The Kansas City Fed offers free economic and personal finance resources for educators, bankers and consumers. We believe individuals of all ages who understand how the economy functions and know what tools are available make better financial decisions. |

| Michigan Department of Education Financial Literacy Identified Programs

A list of financial literacy programs available to you selected as meeting the two criteria established. The programs included show alignment to Michigan Department of Education’s benchmarks and standards and alignment with one or more of the State Board of Education’s initiatives. |

|

| Money As You Learn

offers educators FREE tools to integrate personal finance into the teaching of the Common Core State Standards in Mathematics and English Language Arts, as well as into other classes and after-school programs. This approach can both provide students with essential personal finance understandings and skills and strengthen teaching of the Common Core through meaningful, real-world contexts and applications. It can also enhance the cross-cutting skills such as problem-solving, research, and analysis called for in the Common Core. |

|

| Money Management International

Welcome to MoneyManagement.org, the online home of the nation’s largest nonprofit, full-service credit counseling organization. Since 1958, our organization has proudly fulfilled its mission of improving lives through financial education. We believe the keys to successfully achieving this mission are providing high quality counseling services, offering a wide array of financial education programs and tools, and generating community involvement at both the local and national levels. |

|

| MoneySkill

is a FREE online reality based personal finance course for young adults developed by the AFSA Education Foundation. This interactive curriculum is aimed at the millions of high school and college students who graduate each year without a basic understanding of money management fundamentals. The course is designed to be used as all or part of a grade for courses in economics, math, social studies or where personal finance are taught. Students experience the interactive curriculum as both written text and audio narration. In addition, frequent quizzes test their grasp of each and every concept. The 36-module curriculum, with pre- and post -tests, covers the content areas of income, expenses, assets, liabilities and risk management. A 12-module curriculum is available for middle school and high school students. |

|

| NEFE High School Financial Planning Program

National Endowment for Financial Education (NEFE) High School Financial Planning Program The HSFPP consists of a seven unit student manual, instructor’s guide, and a dynamic suite of Web pages that offer a large, continually growing collection of resources, articles, and financial tools for teachers, students, and parents. Curriculum, teacher guide and student workbooks are provided free to educators. |

|

|

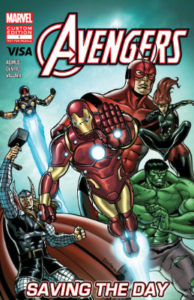

New Marvel Comic Helps Kids Defeat Financial Missteps

In an action-packed new comic book from Marvel and Practical Money Skills, Spider-Man and the Avengers team up to defeat Mole Man and his evil army while learning important financial skills. The free comic, which targets students in grades 2 through 7, features a budgeting worksheet, key finance terms and an accompanying instruction guide for teachers. |

| Next Generation

Next Generation is a high school education program focused on insurance and financial planning basics that include lesson plans and worksheets, along with videos, quizzes, and additional resources to help students develop financial management skills to navigate real-world situations. Learn more about the program and how to integrate the lessons into your curriculum. Click here. |

|

| Next Gen Personal Finance

Next Gen Personal Finance offers a free online curriculum of 60+ complete lessons and 80+ standalone activities you can access from anywhere. Here, you can preview all our lessons and activities and easily access them on the Gooru platform. |

|

| Practical Money Skills for Life

These top-quality financial literacy materials, including classroom modules, games, DVDs and brochures, are free and available for access now by all educators, parents and consumers. |

|

|

San Francisco

Includes the Is College Worth It? Financial Calculator, personal finance lesson plans, as well as an American Currency Exhibit. |

| Smart Money, Smart Kids

They think they’re just having fun. But you know better! Your kids will learn the value of hard work, and why serving others and giving to help those in need are so important. They’ll also see how saving money now adds up to a brighter future. These are big-time lessons all wrapped up in fun!

|

|

|

St. Louis

Federal Reserve Bank of St. Louis has numerous offerings for elementary through high school students and beyond. Interactive lesson plans, on-line courses, podcasts and more are available on a plethora of subjects, all of which can be selected via a set of four filters. |

| Take Charge Today

A program and curriculum with a decision-based approach to personal finance. Formerly Family Economics & Financial Education, Take Charge Today provides a consistent framework for thinking through financial choices in order to improve well-being. More than 75 lesson plans have been designed, tested, and edited in collaboration with university researchers, financial industry experts and our own Master Educator Teams of current classroom educators. Lesson plans are continuously updated, based on classroom feedback and current research, to incorporate new financial products and regulations. |

|

| The FED

The Federal Reserve Bank is in the news almost every day! Why? How does the FRB impact the lives of your students and their families? What do they do?The What We Do Lesson Plan Kit has been produced by the Federal Reserve Bank of Chicago especially for middle and high school classes in business/economics, social studies, FACS or history. It aims to help you teach about the role of the nation’s central bank. Included are a DVD that outlines the role and responsibilities of the Fed, a game that helps students understand the concept of inflation, and a take-home assignment that requires the students to reflect on what they have learned.Click here to learn more and to order. |

|

| The Stock Market Game

The SIFMA Foundations acclaimed Stock Market Game program is an online simulation of the global capital markets that engages students in grades 4-12 in the world of economics, investing and personal finance, and prepares them for financially independent futures. More than 700,000 students take part every school year across the country and the program has reached more than 15 million students since its inception in 1977. |

|

|

Vault

Vault – Understanding Money – is an interactive platform for grades 4th-6th. It includes 2.5 hours of instruction on topics including savings & investing, credit & debt, financial responsibility & decision making. Upon completion of each module, students “unlock” a game where they can apply their learning in a variety of story based activities and simulations. |